Investors

Annual Report 2021

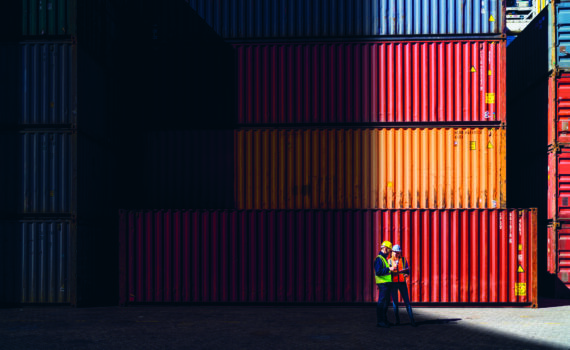

We are the bank for the new economy – of people and ideas, of technology and trade

2021: A year of being here for good

Our performance

30.7%

of our senior roles are held by women

2.1m

active affluent clients

$9.2

bn in sustainable assets

6%

Return on tangible equity (underlying)

$14713

Operating income (underlying, millions)

Dr José Viñals | Group Chairman

Group Chairman’s statement

2021 was another year of extraordinary global turbulence, with recovery from COVID-19 a mixed picture across the globe. Many of our colleagues were adversely impacted in their personal or work lives. Even now, we continue to see new COVID-19 variants emerging and we have had to adapt to a constantly changing landscape.

Read the Group Chairman’s statement in full

Throughout this period, our colleagues around the world – led by our Group Chief Executive Bill Winters and the Management Team – have continued to focus on protecting the interests of shareholders, while ensuring the wellbeing of colleagues and supporting our customers, clients and communities. The spirit our colleagues have shown throughout, despite the often difficult circumstances, has been exemplary and I am extremely proud of how we have all come out of 2021.

Our financial performance is improving

Later in this report, Bill and Andy Halford, our Group Chief Financial Officer, will set out more detail on our financial performance as we navigated the second year of the pandemic. Overall, our results show evidence of resilience, with performance improving against a difficult backdrop.

Our underlying profit before tax at $3.9 billion, grew 61 per cent on a constant currency basis. This was supported by low levels of impairment, a return to positive income momentum in the second half of 2021 and cost control. We have continued to invest in the future of the Group, including stepping up our innovation and technology investment, and we now have an exciting set of transformative business development opportunities and partnerships, many of which we showcased at our investor event in October.

The Group is highly liquid and well capitalised with a Common Equity Tier 1 (‘CET1’) ratio of 14.1 per cent. The Board has recommended a final dividend of 9 cents per share, or $277 million, with the full year dividend an increase of one third from 2020. We have also announced a share buy-back programme and will shortly start purchasing and then cancelling up to $750 million of ordinary shares.

The Board is committed to operating within the 13 to 14 per cent CET1 ratio range and we are very clear that capital not needed to fund growth will be returned to shareholders. We have returned $2.6 billion of capital to shareholders over the last three years through a mix of dividends and share buy-backs. This included paying out the maximum amount we were authorised to in 2020 when the emerging pandemic resulted in a suspension of distributions.

We are delivering against our strategic priorities

While the pandemic brought about considerable challenges and, as a result, the turnaround is taking longer than previously anticipated, it is clear to us that the refreshed strategic priorities we set out at the start of 2021 are right. Our ambition of delivering 10 per cent return on tangible equity remains as resolute as ever and we are working to accelerate its achievement by 2024. In Bill’s report the actions we are targeting are outlined, which includes active management of the Group’s capital, with a target to return in excess of $5 billion in the next three years.

Our strategy brings the dynamism of our markets to life in our business. Our focus is now on executing against the priorities at pace, and we are making progress on each of them. Our Network and Affluent businesses remain key competitive differentiators, both strong generators of high-quality and higher-returning ‘capital-lite’ income streams. We are transforming our ability to onboard, serve and exceed the expectations of our Mass Retail customers, which will help to feed our higher-margin Affluent business, as well as being a significant source of income.

Sustainability is a moral imperative and an opportunity. Our Sustainable Finance capabilities are not only making a difference where it matters the most, but also representing a growing source of income.

We are accelerating our pathway to net zero

We have long recognised climate change as one of the greatest challenges of our time, given its widespread and proven impact on the physical environment and human health, as well as its potential to hamper economic growth. The complex trade-offs which come with climate actions mean there are no simple answers. We announced our net zero roadmap in October, following extensive engagement with shareholders, clients and NGOs. The approach was reviewed and approved by the Board and included interim targets to reduce financed emissions and mobilise $300 billion in green and transition finance by 2030. Our approach emphasises the need for a just transition to net zero: the impacts of climate change are felt most severely in our footprint, and if we do not meet climate objectives in a way that recognises the need for markets across Asia, Africa and the Middle East to grow and prosper, we will fail.

We continue to enhance our governance and culture

While the Board has been unable to meet in a number of key markets in person this year, we have stayed engaged virtually. Members of the Board attended a number of subsidiary board and committee meetings and held virtual Board-workforce engagement sessions across our regions during the course of the year. The Board hopes to be able to once again engage colleagues in person during 2022 as part of its market visits.

We recently announced several changes to our Board Committee composition, details of which can be found in the Directors’ report on pages 90 to 191. During the year, we refocused our Brand, Values and Conduct Committee to Culture and Sustainability. This Committee, chaired by Jasmine Whitbread, has been actively involved in supporting the Board and the business in relation to our net zero approach. The Board was also heavily involved in the key decisions ahead of endorsing the Group’s net zero white paper, published in October ahead of COP 26.

We are taking ambitious Stands

The Group has built a unique footprint in the world’s most dynamic markets, serving the people and businesses that are the engines of their growth. As the bank for the new economy, we will ensure we continue to shape our business to drive their success – and ours – for the future. We have a huge opportunity to build a better future with our customers and communities. We believe that we can fulfil our Purpose – to drive commerce and prosperity through our unique diversity – without people being left behind, without the planet being negatively impacted, and without creating divisions that diminish our sense of community.

We’re taking a set of Stands to help solve some of the world’s most critical problems – lifting economic participation, helping emerging markets reduce carbon emissions, and supporting a fairer model for globalisation. As well as addressing societal challenges, we believe these long-term ambitions will stretch and motivate the Group to deliver our strategy faster and better.

We’ve rallied together for our communities, reaching more than 300,000 young people through our Futuremakers programme to support education, employability, and entrepreneurship across our markets during the year. All these achievements, and more, speak to the heart and mettle of who we are. They are a testament to our valued behaviours of being Better Together, endeavouring to Do the Right Thing, and putting our best foot forward to Never Settle. These attributes, along with the resilience and adaptability of our colleagues, are critical for us. We must continue to build on our culture of excellence, which is client-centric, diverse and inclusive, to deliver on our aspirations to be truly high-performing.

Our outlook is bright despite an uncertain environment

Whilst uncertainties persist in relation to COVID-19 and the geopolitical landscape, we see plenty of opportunities that are compelling.

Global growth is expected to continue in 2022 albeit somewhat slower after the sharp recovery we saw in 2021. Asia, our largest region, is poised to remain the fastest growing area in the world.

We expect policy support to scale back, as a number of central banks tighten policy to counter inflation leading to rising interest rates, and fiscal programmes are eased.

We continue to see accelerated change across the global business ecosystem, from the digital space, to trade flows and supply chain shifts, and these are just some of the reasons why we are excited at the prospects of the Group.

The Board will continue to oversee the task of striking the right balance between the opportunities and risks that we see. I am confident that, with the actions we have outlined to continue driving and indeed accelerating our strategic priorities, we will create long-term and sustainable value for our stakeholders.

Bill Winters | Group Chief Executive

Group Chief Executive’s statement

Our performance in the second half of 2021, and into this year, gives us confidence that we are on track to achieve our strategic and financial objectives. We saw a return to income growth, which we believe signals the start of a sustainable recovery, and we finished the year with good business momentum in Financial Markets, Trade and Wealth Management. Good cost discipline allowed us to generate positive income-to-cost jaws in the second half of the year.

Read the Group Chief Executive’s statement in full

Continued low levels of credit impairment have helped us increase profit by 61 per cent on a constant currency basis to $3.9 billion and deliver a return on tangible equity (RoTE) of 6 per cent. Confidence in our overall asset quality and earnings trajectory allows us to return significant capital to shareholders: we are announcing today a $750 million share buy-back, starting imminently, together with a 12 cents per share full-year dividend, up a third on 2020. We are also committing to deliver substantial returns to investors over the next few years while managing our Common Equity Tier 1 (CET1) ratio dynamically within our 13 to 14 per cent range. We remain liquid, well capitalised and soundly positioned for the year ahead.

Confidence in our purpose and strategy

The places Standard Chartered call home are the world’s most dynamic markets, setting the pace for global growth. The people and businesses we serve, connect and partner with are the engines of the new economy of trade and innovation, and central to the transition to a fair and sustainable future. Our Purpose is to drive commerce and prosperity through our unique diversity. This infuses everything we do, connecting our strategy with opportunities to drive growth and deliver our societal ambitions.

To help us deliver our Purpose, we have defined three ‘Stands’, areas where we have long-term ambitions: Accelerating Zero, Lifting Participation and Resetting Globalisation. Representing some of the main societal challenges of our time, these are not separate from our strategy, but integral to delivering and accelerating it: stretching our thinking, action and leadership. We have managed seismic changes over the last two years and these external challenges have helped us understand how we can accelerate our progress. Our strategy is as relevant now as it was pre-pandemic:

- The growth of the Affluent segment in our markets has continued apace and remains one of our greatest opportunities. Since 2018, the number of clients has increased by around 400,000 and assets under management are up $52 billion. We see opportunities to accelerate this growth through further digitisation, partnerships and investment

- The trade flows across our Network remain as vibrant as ever and our unique physical footprint enables us to serve clients as they continue to trade and expand across borders. Network income has grown by around 6 per cent annually since 2018, excluding the impact of interest rate headwinds

- The pandemic stress-tested our Mass Retail business and we have fared well. This segment is back on track, and we see opportunities to develop it further with our range of proven digital capabilities and growing list of exciting partnerships. In 2021, our Credit Cards and Personal Loans business returned to profitability with a strong improvement in the cost-to-income ratio

- Our Sustainability agenda and thought and action leadership remains a key priority as the world continues to face significant environmental and climate challenges. We see this as both an imperative and an opportunity. We are determined to deliver on our plans – to reach net zero in our operations by 2025 and in our financed emissions by 2050. This year we announced interim targets to reduce financed emissions by 2030 in the most carbon intensive sectors. To provide transparency and support collective learning, we published a detailed white paper outlining our methodology and approach. We are also focused on accelerating growth in Sustainable Finance, with plans to mobilise $300 billion in green and transition finance by 2030 and we are strengthening our sustainability capabilities in our Consumer, Private and Business Banking (CPBB) business.

The long-term fundamentals of the markets in which we operate have not changed. These markets, notably China and other markets in Asia, will drive future global economic growth over the coming decades. We are confident we have the right strategy to capture the opportunities that will arise from those trends, and we can see evidence that it is working.

Taking action to simplify, focus and accelerate our path to 10 per cent RoTE

When we presented the Group’s refreshed strategy to the market in February 2019, we set out our plan to deliver 10 per cent RoTE by 2021. In the year that followed we grew income and RoTE. But COVID-19 triggered an economic downturn and related reduction in interest rates, inevitably squeezing our margins and reducing income and returns sharply. Against this backdrop, we have not achieved the returns we seek for investors. With this in mind, we have conducted a comprehensive review of our business model and strategy. There are many areas where we have made good progress in recent years despite the pandemic, including returning CPBB to profitability in China and Korea, almost trebling the cumulative operating profit from our four large optimisation markets and releasing around $15 billion of RWA through exits, including the sale of our Permata joint venture. But we concluded that we must make changes to accelerate our path to 10 per cent RoTE by 2024. We will accelerate our execution and are implementing plans to simplify our business and sharpen our focus on where we are most differentiated. By 2024 we are targeting:

- About a 160-basis point improvement in Corporate, Commercial and Institutional Banking (CCIB) income return on risk-weighted assets (RWA) through optimisation and mix changes, enabled by a $22 billion reduction in RWA from exits and efficiencies combining to hold CCIB RWA at 31 December 2021 levels

- A cost-to-income ratio in CPBB around 60 per cent, down from 76 per cent in 2021, achieved by growing income and executing a $500 million business expense reduction programme

- A $300 million investment into our China-related businesses to capture the opportunity from China’s continued opening and doubling its profit contribution. Our positioning in China has never been better and the opportunities for us never more attractive

- $1.3 billion of gross cost efficiencies to help offset inflation, create room for continued investment and maintain positive jaws of 2 per cent per year on average, excluding interest rate rises

- Active management of the Group’s capital position with a cumulative capital return in excess of $5 billion equating to a fifth of our current market capitalisation and more than double the amount of the previous three years

As well as these five measures, we have an overarching objective to improve returns in markets and business lines which are not meeting our financial objectives and to continue to simplify the management of the Group. We review these questions regularly and will take actions as appropriate. For example, we recently announced the merger of the Technology and Operations functions into one global organisation, simplifying the structure and driving synergies.

Our actions are designed to amplify the positive impact of the improving outlook

The macro-economic environment remains important to the delivery of our financial ambitions. By the end of 2021 falling rates over the last two years have driven a greater than $2 billion reduction in net interest income which we have been working hard to replace. With the interest-rate cycle showing signs of turning, and given our positive gearing to US-dollar rates, we should recover this lost income.

We have said that we expect the Group’s metabolic rate of income growth to be 5-7 per cent. This reflects our strong and improving market positioning and average GDP growth across our footprint where Asia is expected to outpace growth in the rest of the world by around 2 per cent over the next three years. The specific asset and revenue pools that we are targeting with our strategy are also growing. By 2025, Asia Affluent assets and the Asia, Africa and Middle East Mass Retail revenue pool are expected to grow annually by 9 per cent and 7 per cent, respectively, compared to 6 per cent and 5 per cent, respectively, for the rest of the world.

In addition to our metabolic income growth rate, we expect that interest rate rises could add about a further 3 per cent, driving average income growth rates of 8-10 per cent to 2024, accelerating the achievement of our returns aspirations. The improvements in external conditions, however, are not guaranteed and substantial uncertainties persist, in particular regarding geopolitical tensions and the evolution of inflation and interest rates. As such, we are fully committed to taking the operational actions outlined above to underpin attainment of double-digit RoTE.

Confident in the future

We are confident we can deliver our strategy, building on the significant progress we have made over the past several years and the momentum we have coming into 2022. Whilst uncertainty persists in relation to COVID-19, we also see significant opportunities emerging:

- Government and Central Bank policies are in transition, creating volatility that can benefit our capital-lite Financial Markets and Wealth Management businesses

- Accelerated trade flows and supply chain shifts across our footprint markets are increasing the demand for Trade solutions

- Sustainability is critical and an increasing priority for both clients and governments – and we are uniquely positioned to support them

- Our clients are accelerating their pivot to digital with increasing willingness and desire for digital-first banking

- China is opening up at an accelerating pace, supporting the opportunities for which we have positioned for the past decade

- Expected interest rate rises could add significant further upside to our income growth rate

Outlook

The Group remains in great shape and in an enviable position. We exit the second year of the pandemic rooted in markets with strong growth prospects. We have the right strategy, business model and ambition to deliver on this potential. We have shown a resilient financial performance in 2021 and have set out clear actions to achieve a RoTE of 10 per cent by 2024.

Finally, I would like to highlight the remarkable efforts of our 82,000 colleagues again this year. Their commitment and endurance in challenging circumstances has delivered a seamless service to our customers and communities that we serve.

The bank for the new economy

Driving success for our clients through collaboration and innovation

Mox goes from strength to strength

Mox, our digital banking service for Hong Kong-based customers, went from strength to strength in 2021 and now has more than 200,000 users – triple the figure for 2020. The app, which includes a Goals and Savings calculator helps customers better manage their money. Mox, was first launched in 2020.

Supporting sustainable trade across the globe

We launched the Sustainable Trade Finance Proposition – an initiative to help companies implement sustainable practices and develop more resilient supply chains. The proposition supports the financing of sustainable goods, assists sustainable suppliers and helps carbon intensive industries transition.

Direct access to relationship managers with my RM

To give our Singapore-based affluent clients the service they want, when they need it, we launched the My RM app. The app allows clients to talk to their relationship managers via text or calls, as well as authorising investment transactions. The tool is part of the upscaling of our regional affluent business.