Should sustainability-driven payment innovations be part of treasury’s ESG toolkit?

As the goal to achieve net zero continues, corporate treasurers are looking beyond making their supply chains more sustainable – they are also seeking sustainability-driven innovations in other areas such as payments and collections. Here, we examine the latest developments in sustainability and the challenges facing treasurers in successfully adopting them.

The COVID-19 pandemic turbocharged sentiment towards environmental issues globally. Research1 found that, following the pandemic, 85 per cent of consumers are willing to take personal action to combat environmental and sustainability challenges, while 58 per cent are now more mindful of their impact on the environment than they were before March 2020.

From a corporate treasury perspective, sustainability is increasingly important in recent years. And banks have helped to support this burgeoning focus through initiatives including green bonds and investment funds, innovations in cash management, and supply chain solutions such as sustainable financing programmes.

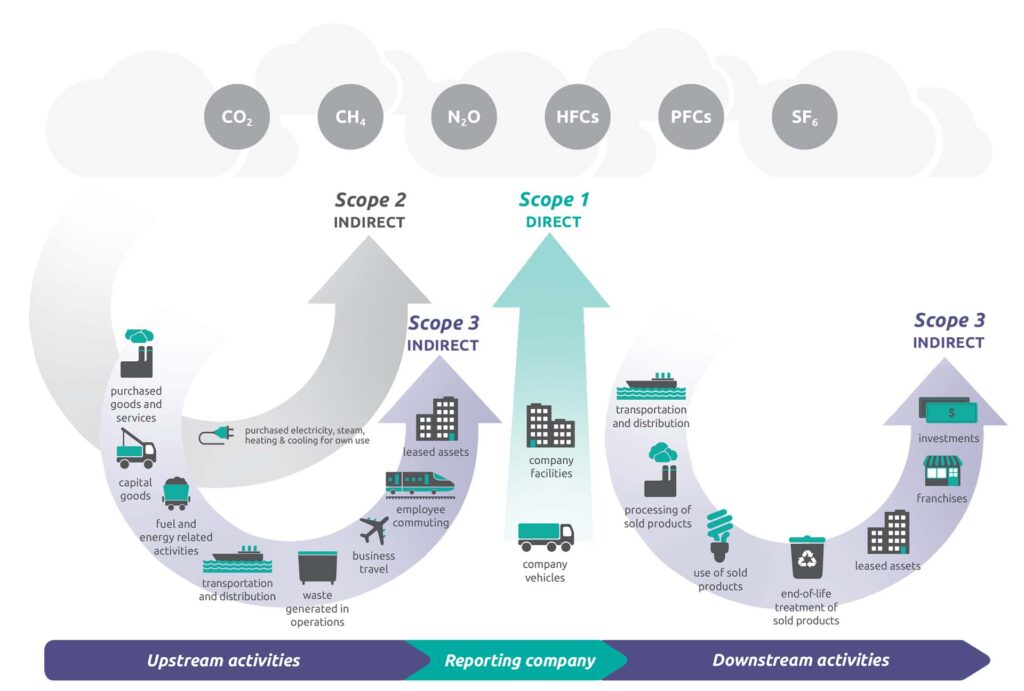

The focus on moving towards net-zero goals has also intensified in recent years among corporates and their treasury functions. This includes the need to understand, measure, and reduce greenhouse gas (GHG) emissions falling under the banners of Scope 1, 2 and 3 according to the GHG Protocol (see fig. 1) – as a means to honour the 2015 Paris Agreement.

Fig 1: Overview of GHG Protocol scopes and emissions across the value chain

This is highly relevant to finance teams, believes Kai Fehr, Global Head of Trade and Working Capital, Standard Chartered, since the GHG Protocol has determined a Corporate Value Chain (Scope 3) Accounting and Reporting Standard2. Moreover, at its October 2022 meeting, the International Sustainability Standards Board (ISSB) confirmed the inclusion of Scope 3 disclosure as set out in its draft Climate-related Disclosures Standard given feedback from investors that they cannot fully understand a company’s transition risk without information about its absolute gross Scope 1, 2 and 3 emissions3.

Yet measuring these emissions, especially those in the Scope 3 – value chain – category, can be tough. Fehr comments: “Multinational companies [MNCs] are feeling the pressure, and with 73 per cent3 of their total emissions sitting in their supply chain, their challenge is far from simple.”

Research4 from Standard Chartered suggests that buyers are taking a rigorous approach to this challenge. For 67 per cent of MNCs, reducing supplier emissions is the first step in their net-zero strategy, underlining the importance of supply chains in carbon transition. In addition, 78 per cent say they will start removing slow-to-transition suppliers by 2025. “Overall, our clients tell us that they expect to review around 35 per cent of their current suppliers as they respond to net-zero pressure. They anticipate that suppliers in emerging economies are more likely to be among those impacted given the challenges in transitioning,” adds Fehr.

The payment ecosystem today is dynamic and there is a wide range, and ever-growing list, of digital payment options available to consumers (C2B) and corporates (B2B) alike. Keeping up is a challenge and can even increase the cost of doing business – far from what was hoped for when digitisation of payments processes linked to sustainability was first conceptualised.

Straight2Bank Pay is a game-changer for businesses looking to make more digital payment options available to their consumers, without the need for multiple integrations and collection accounts with providers across markets.

The solution can be tailored to different business needs, providing a unified digital commerce solution – with no need for paper – across all sales channels and business models. This includes collections online, via mobile devices, in physical stores, at remote locations, payment on delivery, and invoice payments – often powered by QR codes or payment links.

In addition to benefits from sustainability and efficiency, consumers enjoy a seamless payment checkout experience, which is beneficial for conversion and retention.

Yet many MNCs are also working with their suppliers to help them transition, rather than simply cutting ties. “Many MNCs are developing shared goals with their suppliers, and some are offering additional benefits and better prices to decarbonising suppliers. This is a trend that must grow if businesses are to embrace the challenge of global net-zero transition,” observes Fehr.

Indeed, according to Standard Chartered’s research:

And The Sustainability Commitment Paradox, a new research report by Standard Chartered, reveals that 44 per cent of mid-sized companies and 39 per cent of large anchor corporates plan to provide incentives for their suppliers to produce more sustainable products and operate in more sustainable ways.

From these aspirations it is clear that buyers and banks have a great deal of work to do together as they face the goal to achieve net zero. But this should also be a wake-up call for suppliers, emphasising the need to understand the sources of emissions and their impacts in a more meaningful way. Moreover, the international element will be critical to determine, since suppliers may be meeting emissions standards in their own markets, but risk losing business as they are not meeting the standards set in the markets they are supplying.

There is a growing impetus for treasurers to contribute to the sustainability agenda of their organisations by examining new possibilities. This goes beyond sustainable supply chains and includes other areas of responsibility such as cash management and payments.

For payments, sustainability has – thus far – mostly manifested as a by-product of digitalisation. “Consumers and shareholders are increasingly valuing sustainability credentials. Businesses can benefit from going beyond digitising payments and collections, and contributing more to sustainability through other aspects of cash management,” observes Philip Panaino, Global Head of Cash Management, Standard Chartered.

Treasury is uniquely placed as an enterprise-wide sustainability champion, and driver of its initiatives, because it has become a trusted consultant and collaborator not just with other functions but also, ultimately, at C-level.

Banks, as close partners, are also refining other aspects of their cash management offerings to support corporate treasurers in their sustainability goals.

Gaining visibility into the impact of sustainable finance assets should be as simple and easy as gaining cash visibility. An example here is an innovative current account such as the Sustainable Account, which helps treasurers embed sustainability into cash management.

Treasurers face challenges balancing their liquidity management needs with a commitment to sustainability to address the world’s most pressing challenges. The Sustainable Account is designed to offer corporates the flexibility of an account solution, where they can retain access to their cash for day-to-day liquidity requirements and use surplus cash to support the United Nations Sustainable Development Goals (UN SDGs).

Deposits that a corporate treasurer places into Standard Chartered’s Sustainable Account will be referenced against projects aligned with the bank’s Green and Sustainable Product Framework. This framework, which guides what qualifies as green and sustainable, is mapped to the UN SDGs, and is co-authored with industry expert Sustainalytics.

“Our Sustainable Account caters to the increasing demand from corporate clients for simple, innovative, and credible sustainable banking solutions,” adds Philip Panaino, Global Head of Cash Management, Standard Chartered.

Despite these positive examples, banks with sustainability-driven payment innovations for their corporate customers are still in the minority. This is perhaps because there are so many aspects to consider when relating sustainability to treasury transactions.

This is a space to watch and it also presents corporate treasurers with the chance to work closely with their partner banks on opportunities to pilot new ways to manage their cash more sustainably.

For example, to meet the increasing demand from corporate MNCs and mutual stakeholders for greater transparency and access to sustainable production and related payment transactions, Standard Chartered, together with the Singapore FinTech Association (SFA) as its knowledge partner, recently published the Deepening Sustainability with DLT paper that explores how the confluence of stakeholder interests can align sustainability transparency in supply chains.

The paper advances knowledge on complex topics such as distributed ledger technology (DLT) and how it can be used in supply chain payments for corporates, FIs, and their corresponding ecosystems.

“While many questions remain to be asked and answered around sustainability-driven payment innovations and cash management solutions, this dialogue presents an opportunity for treasurers to talk to their banking partners and emphasise what is needed to support their organisational goals,” concludes Panaino.

1 https://www.mastercard.com/news/media/qdvnaedh/consumer-attitudes-to-the-environment-2021.pdf

3 https://www.sc.com/en/insights/carbon-dated/

This article was also published on Treasury Management International.

Sustainability is important to you and to us. It’s why we’re bringing you sustainability-linked financing solutions.