What financial services can learn from the food industry

Consumers are now starting to apply more scrutiny around the sustainability of their everyday choices, from food and fashion to transportation, housing and their financial transactions.

The consumer demand for organic food is growing steadily, enabled by the industry’s progress in making information and labelling more standardised.

Similarly, sustainable fashion is becoming more popular, but the industry struggles with a common definition on what constitutes sustainable clothing – this lack of clarity is a barrier to higher consumer adoption.

Multiple industries struggle with standardisation when it comes to identifying sustainability criteria. Interestingly, at a panel discussion on sustainable fashion, one of the panellists pointed to the finance industry as an example of progress towards standardisation and consistent labelling.

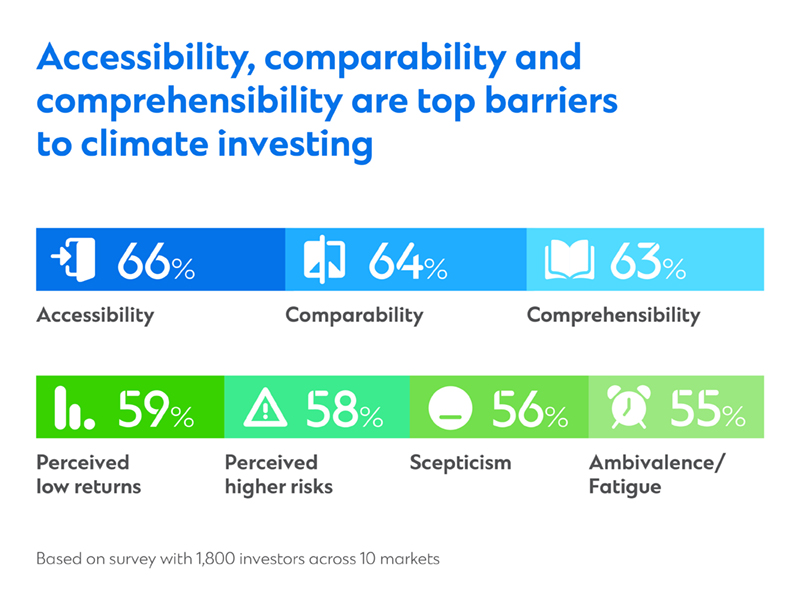

While there has indeed been progress, the finance industry is not moving fast enough – our latest investor survey shows the lack of standardisation, comprehensibility and comparability continue to be the top barriers preventing investors from higher allocation into sustainable investments.

More work needs to be done for consistent labelling of sustainable banking products and an easy‑to‑understand narrative about their potential impact.

The industry also needs to simplify information given to investors by minimising jargon and breaking down complex concepts, particularly in the climate investing space.

Encouragingly, the same survey shows that investors are now more informed about the positive impact of sustainable investing, and how their wealth can potentially help tackle critical global challenges such as climate change.

As investor interests evolve, sustainable investing can help them build more resilient portfolios and capture opportunities matched to their themes of interest in multiple markets. By providing them with clearer information and standardised measurement, we can help them overcome their barriers and mobilise more retail capital towards sustainability goals, including combating climate change.