-

Wealth Expectancy Report 2022

Uncertain times, uncertain investors

Outpacing inflation

Investors are decreasing cash and equities as they diversify their portfolios

With rising inflation, affluent consumers are looking for security and trying to identify investments that are likely to be safe havens in the global economic storm. 65% of investors are more actively managing their wealth and changing investment strategies.

According to our research, the top 3 concerns for investors are:

1. Inflation (34%)

2. Economic uncertainty (27%)

3. Threat of recession (22%)

Our annual survey of investors in 14 growth markets reveals that high inflation is prompting shifts in how they allocate their funds across different asset classes, from cash and equities to digital assets and sustainable investments.

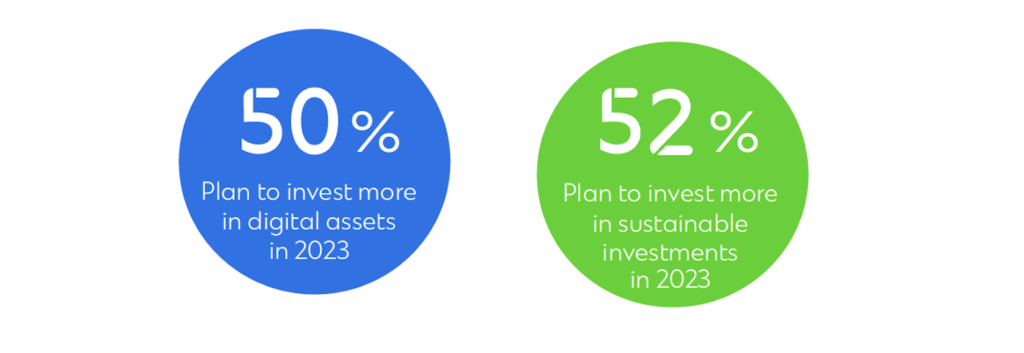

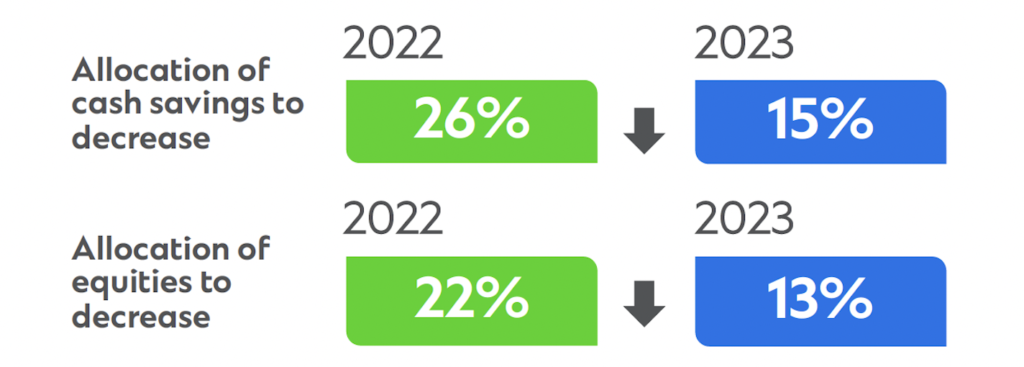

Across the 14 markets surveyed, key shifts within investors’ portfolios include:

Investors are diversifying out of cash and equities, and showing interest in emerging asset classes. We expect investment in digital assets and sustainable investments to grow.