-

Private Banking

International. Interconnected. Inter-generational.

Exploration for entrepreneurs and their future generations

Here to help you grow and protect your wealth. As your wealth needs extend beyond wealth management, our 170-year history and presence in 53 markets connects you to a global network of opportunities to help you make the most of your successes and leave a lasting legacy

International connections

Unlocking new opportunities in dynamic markets

Interconnected bank

Serving your personal and business needs

Inter-generational services

Helping you look after your future generations

Wealth insights

Latest insights from the Chief Investment Office team

Tailored solutions

Supporting your wealth aspirations your way

Spot investment opportunities

See our latest Global Market Outlook

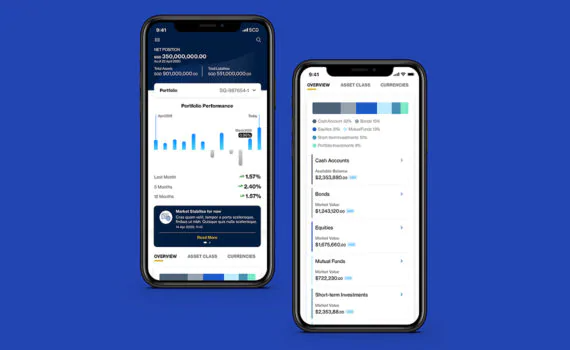

Manage your private banking

Access your account conveniently when it matters

Future-proofing your portfolio

Providing you with opportunities in sustainable investing

Follow us on Facebook

See our daily Wealth insights on social media

We are delighted to be conferred

Latest CIO view across asset classes

Equity

Δ Overweight ∇ Underweight — Neutral

Equity – at a glance —

28 MARCH 2024

- We are Overweight equities, with Japan our top Overweight. The Bank of Japan ending its decade-long ‘negative rate policy’ is a strong vote of confidence in the Japan economy. The BoJ still maintains an accommodative stance, corporate governance is improving and valuation still attractive. US equities is our other Overweight region. The Fed is likely to cut rates, despite slightly higher-than-ideal inflation rate. US companies continue to display strong pricing power, resulting in solid net margins.

- We are Neutral Asia ex-Japan equities. We upgrade India to Overweight. Its economy is growing the fastest among key markets within the region. Fund flow has been strong, and India typically delivers solid returns in an election year. These factors more than compensate for its expensive valuation. We also upgrade Taiwan to Overweight, with strong GDP revisions, a bottoming manufacturing, and a strong semiconductor cycle. We stay Overweight Korea – rising demand for AI-related technology products is likely to support earnings, and the government’s ‘Value-up’ programme may narrow the ‘Korean discount’ by addressing company cross-holdings and improving corporate governance. We are Neutral China equities. Valuation is cheap and sentiment bearish. Deflationary forces remain the key risk, but the government has been intensifying its policy stimulus.

- We downgrade Euro area equities to Underweight. Cheap valuation reflects weak EPS growth. Consumer confidence remains weak, and service inflation remains sticky. UK equities remain Underweight. It has excess exposure to defensive sectors.

North America equities – Preferred holding Δ

28 MARCH 2024

The bullish case:

- Strong earnings growth and momentum

- Technology sector propelling performance

- Delayed economic slowdown

The bearish case:

- Overconcentration on Magnificent 7

- Macro uncertainties: eg, US election

- Expensive valuations. Elevated positioning

Europe ex-UK equities – Less Preferred holding ∇

28 MARCH 2024

The bullish case:

- Well-priced for weak EPS growth

- Improving corporate margins and ROE

- Rebound in manufacturing data

The bearish case:

- Weakening earnings growth

- Heightened recession risk

- Economic rebound unable to sustain

UK equities – Less Preferred holding ∇

28 MARCH 2024

The bullish case:

- High dividend yield

- Valuations extremely cheap

- Relatively defensive sectors

The bearish case:

- Weak earnings growth expected in 2024

- Light in growth sectors

- Forward guidance deteriorating

Japan Equities – Preferred holding Δ

28 MARCH 2024

The bullish case:

- Strong corporate balance sheets

- Rising ROE from corporates reform

- Further improvement in earnings outlook

The bearish case:

- Less compelling in valuations

- Rebound in JPY to hurt company earnings

- Rising volatility from a tightening BoJ

Asia ex-Japan equities – Core holding —

28 MARCH 2024

The bullish case:

- Higher EPS growth projected in 2024

- Rising demand for semiconductors

- China’s fiscal and monetary stimulus

The bearish case:

- Soft survey data and economic activities

- Lack of confidence from investors

- Persistence in geopolitical tensions

Bonds

Δ Overweight ∇ Underweight — Neutral

Bonds – at a glance —

28 MARCH 2024

- We are now Neutral Developed Markets (DM) Investment Grade (IG) government bonds. A higher likelihood of US soft-landing has prompted us to reduce our Fed rate cut expectation this year to 75bps. We expect the US 10-year government bond yield to stay within a 4.00-4.25% over the next 3 months, but now expect a relatively more muted move to 3.75-4.00% over the next 12 months. Overall, we still see yields as attractive, but price gains may be more muted relative to our start-of-year expectations. We remain Neutral DM IG and DM High Yield (HY) corporate bonds given attractive yields, but yield premiums offer only a limited buffer against a growth slowdown.

- We raise our preference of EM USD government bonds to Neutral. Our expectation for more supportive commodity prices in the next 12 months is a positive. In addition, nominal yields continue to be attractive. Their high sensitivity to falling US bond yields is also a positive. We are Neutral EM local currency government bonds given our flat USD view. In Asia, we are Neutral Asia USD bonds, with a preference for Asia HY over Asia IG, on expectations of fiscal and monetary support in the region.

Developed Market Investment Grade government bonds – Core holding —

28 MARCH 2024

The bullish case:

- Attractive yield

- DM central banks’ pivot

The bearish case:

- ‘Higher for longer’ monetary policy amid a strong economic growth backdrop

- Unfavourable supply-demand balance

Developed Market Investment Grade corporate bonds – Core holding —

28 MARCH 2024

The bullish case:

- High rate sensitivity (long duration) a positive from a peak in interest rates

- Attractive absolute yield on offer

The bearish case:

- Relatively tight yield premium

- Weakening credit fundamentals

Developed Market High Yield corporate bonds – Core holding —

28 MARCH 2024

The bullish case:

- Corporate credit fundamentals are still looking solid

- Attractive yield on offer

The bearish case:

- Rating downgrade risk

- Surge of default risks

Emerging Market USD government bonds – Core holding —

28 MARCH 2024

The bullish case:

- High rate sensitivity (long duration) a positive from a peak in interest rates

- Commodity prices

The bearish case:

- Commodity price disinflation

- Geopolitical risk amid elections in the US and key EM countries

Emerging Market Local currency government bonds – Core holding —

28 MARCH 2024

The bullish case:

- Supportive EM currency outlook

- High EM monetary policy flexibility

The bearish case:

- Unfavourable yield differentials with DM

- Rate cut expectation is in the price

Asia USD bonds – Core holding —

28 MARCH 2024

The bullish case:

- Regional growth continues to impress

- Attractive yield

The bearish case:

- Soft China economic growth outlook

- Defaults or bond restructuring risk

Commodities

Δ Overweight ∇ Underweight — Neutral

Commodities – at a glance

28 MARCH 2024

- We remain Neutral on gold vs. other major asset classes, seeing it as a portfolio ballast against any meaningful recession and geopolitical risks. The gold market has been on a tear in March on higher tactical demand and continued official sector appetite. We expect gold prices to rise to USD 2,200/oz over the next 12 months as rate cuts materialise, dragging real yields lower. Meanwhile, institutional investors could increasingly add to their positions on higher rate cut expectations. Structural central bank demand remains a key driver, but they could delay purchases, given current elevated prices. However, overbought conditions and lacklustre ETF flows are short-term drags. Thus, gold is prone to corrections in the next 3 months, in our view.

- We revise our 12-month WTI oil forecast higher to USD 81/bbl amid tighter demand-supplydynamics. On demand, conditions remain firmer than expected as most major economies, in particular the US and China, showed little signs of a slowdown. In terms of supply, the extension of OPEC+’s 2.2mb/d of voluntary cuts into the second quarter limits the upside for crude oil supply. Moreover, thin spare capacity and low producer elasticity mean that US output is unlikely to see new highs. In the near term, we maintain the view that the oil markets are likely to be in deficit given the elevated demand from the still-robust global economy. This suggests a higher WTI oil price at around USD 84/bbl in the next 3 months.

Crude Oil

28 MARCH 2024

The bullish case:

- Resilient DM economies

- Stable demand growth in Asia

- Supply reduction from geopolitical conflicts

- OPEC+ supply cuts

- Low inventories

- US shale underinvestment

- US SPR refill

The bearish case:

- Tight monetary policies and resulting growth slowdown

- Redirection of Russian oil flows

- Easing of sanctions against Venezuela

- Significant global spare capacity

- OPEC+ supply discipline

- Lower demand from energy transition

Gold —

28 MARCH 2024

The bullish case:

- A normalisation in Fed rates

- Escalation of geopolitical tensions

- Safe-haven bids

- Reserve diversification for central banks

- Strong central bank and physical demand

- USD weakness

- Entry of CTAs

The bearish case:

- Rising real yields increase opportunity costs of holding gold

- Geopolitical risk premium in gold tends to be short-lived

- Positive correlation with equities

- Resurgence in USD strength

- Risk-on sentiment

- Demanding valuations

Alternatives

Δ Overweight ∇ Underweight — Neutral

Alternatives at a glance —

28 MARCH 2024

The bullish case:

- Diversifier characteristics

The bearish case:

- Equity, corporate bond volatility

Multi-Asset

Δ Overweight ∇ Underweight — Neutral

Multi-Asset – at a glance

28 MARCH 2024

- The Multi-Asset Income (MAI) portfolio has a current yield of around 6.2% for 2023, an attractive level, in our view. This is a stark contrast to just two years ago when traditional bond yields were low on the back of rate cuts by major central banks and investors were on the hunt for yield. We expect yields to fall as central banks shift away from rate hikes and attention turns to the timing of potential rate cuts in 2024. We believe yields are attractive for investors today.

- Heading into 2024, we are increasing our allocation to bonds. We have increased our allocation to Developed Market High Yield (DM HY) bonds given their high coupon and modest maturity compared with leveraged loans. This is funded by a decline in allocations to Emerging Market (EM) bonds.

- Alongside the recovery in markets, our MAI model allocation has returned c.8.0% YTD. DM HY and EM local currency bonds have been the significant contributors to performance, while dividend equities and covered calls also contributed.

We are here for you

Get in touch now or explore our private banking resources