Spotlight careers

In our Wealth and Retail Banking (WRB) team

Relationship Managers

A global view of our bank

We’re an international bank, nimble enough to act, big enough for impact. For more than 160 years, we’ve worked to make a positive difference for our colleagues, clients and communities.

- There are more than 83,000 of us, from 131 countries and 52 markets, and we speak over 170 different languages and dialects

- We offer banking services that help people and companies to succeed, creating wealth and growth across our markets

- We’re listed on the London and Hong Kong Stock Exchanges.

Being a Standard Chartered Relationship Manager

As a Standard Chartered Relationship Manager, you’ll have the opportunity to build, nurture and grow your affluent client portfolio.

Career growth

We’re committed to offering you a wealth of learning and development tools, to help you get to where you want to be.

Structured career development plan to support your career progression into all sorts of roles, including management positions. It also includes personalised training and development programs, from the day you start, with consideration of your work experience, through on practical on-job training.

Rewards and benefits

We’re committed to offering you a wealth of learning and development tools, to help you get to where you want to be.

In line with our Fair Pay Charter we offer a competitive salary and benefits that support your mental, physical, financial and social wellbeing.

You’ll participate in a structured incentive plan which calculates variable pay based on achievement of a transparent balanced scorecard and demonstration of our Valued Behaviours. Our incentive plan will support you settle in and provides the flexibility to recognise your performance if you deliver more quickly than initially expected. To further support your success, a portfolio of existing clients will be allocated to you.

Open job opportunities

We have vacancies open you can apply to in Taiwan, Singapore, Hong Kong and Malaysia. Click on the job links to apply to the market of your choice. Alternatively you can register to our Talent Network and be matched to roles in the future. Register for our Talent Network.

Meet our Relationship Managers

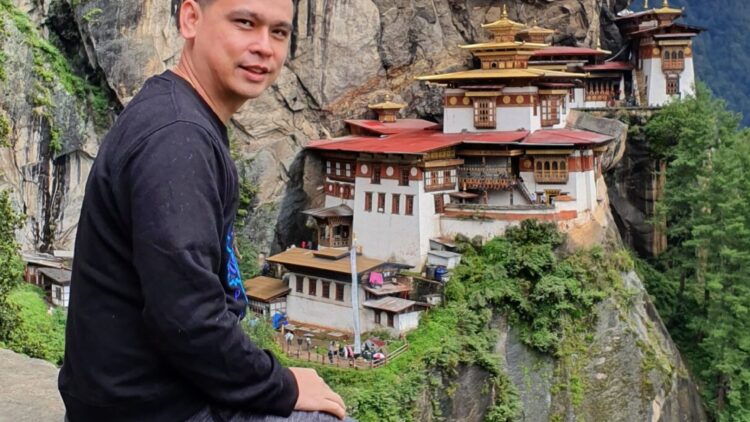

Zhi Hao Chan, Singapore

“Never settle” is one of our valued behaviours. It really resonates with me and I try to live it everyday. It gives me a sense of sense of purpose and motivation.

Poyi Pang, Hong Kong

The career path is something that really attracted me. Promotion criteria is based on capability, which provides a good career opportunity for employees.

Mathew Lau, Hong Kong

Integrity, changing and reliable – that’s how I would describe Standard Chartered.

Keegan Loh, Singapore

Standard Chartered really is like a huge family. The spirit of our valued behaviours and being ‘better together’ is something I experience every day.

Digitising our client experience

We put our Employee and Client experiences at the heart of our business by using cutting-edge technologies and specialist teams dedicated to driving an exceptional client experience. Our new App has transformed how we support our clients.

You’ll use our Professional Client Relationship Management (CRM) system and first-class client engagement tools to support remote sales. And you’ll be supported by a great team of specialists to enable our approach to client service.

Wealth Academy – SC and INSEAD

We partnered with INSEAD, one of the world’s leading and largest graduate business schools to launch the Standard Chartered-INSEAD Wealth Academy to provide client-engagement and wealth management global education programme for our Relationship Managers and Wealth Specialists.

By investing in our people, the Wealth Academy upskills our relationship teams and nurture them to become future- ready advisors, providing timely personalized and high-quality differentiated wealth advice to clients. It helps deepen the relationship teams’ capabilities particularly in the areas of wealth advisory and client engagement.

Hong Kong

Bank of the Year by The Banker.

Bank of the Year by Bloomberg Businessweek.

-2020 –

Best Digital Bank in HK by Asian Banker

Best Digital Bank in HK by The Digital Banker

-2020 –

Best Renminbi Bank in HK by The Asset

Best FinTech Partner in APAC by The Asset

-2020 –

Singapore

Ranked 2nd in LinkedIn Top Companies 2021: The 15 best workplaces to grow your career in Singapore. LinkedIn’s assessment criteria include; ability to advance, skills growth, company stability, external opportunity, company affinity, gender diversity and educational background.

– 2021 –

Highly Acclaimed – Best Digital Customer Experience in Wealth Management (The Digital Banker, Digital CX Award)

– 2020 –

Winner – Best Retirement Product & Services Initiative (Retail Banker International, Asia Trailblazers Award)