International Finance Awards

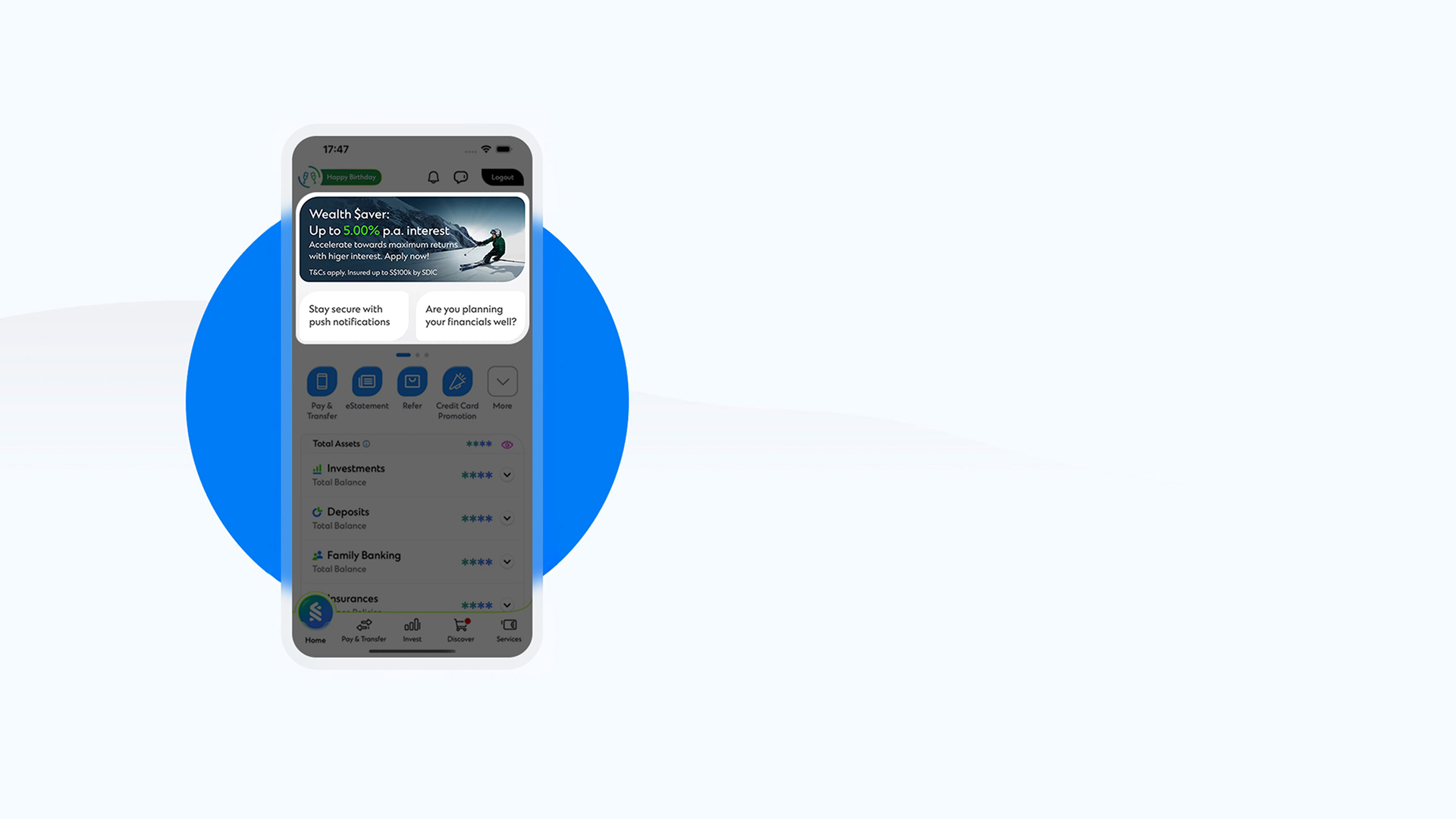

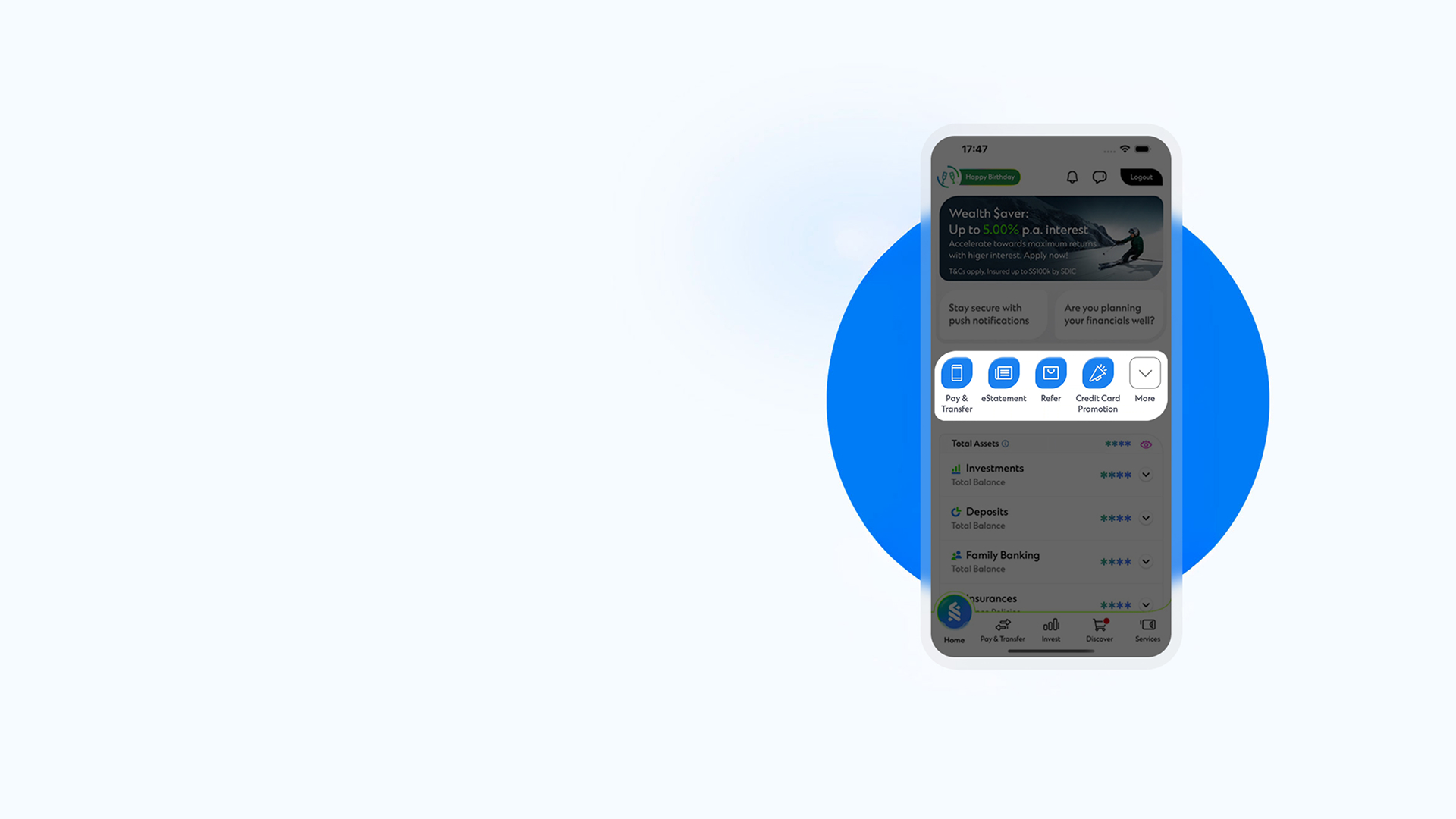

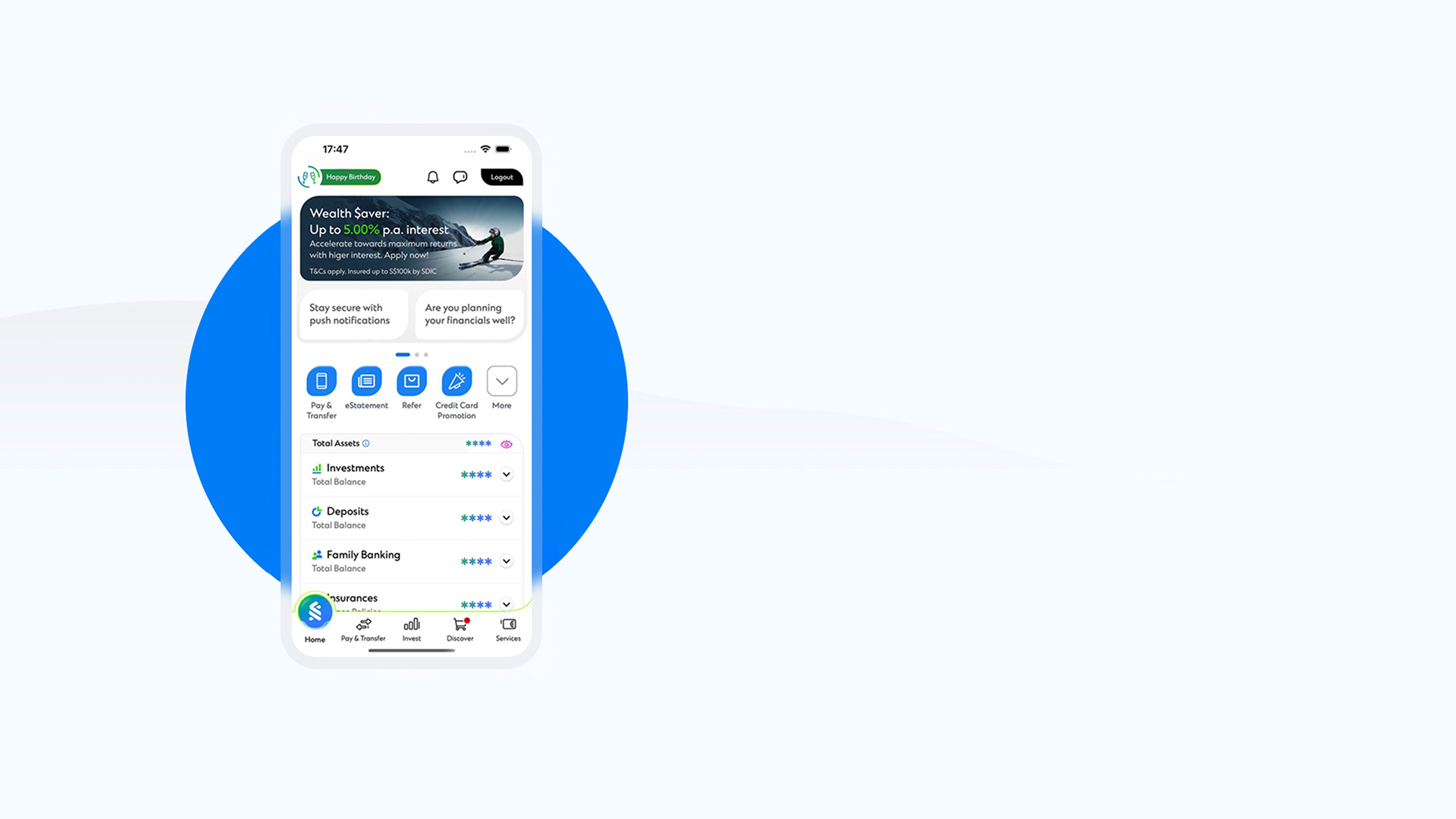

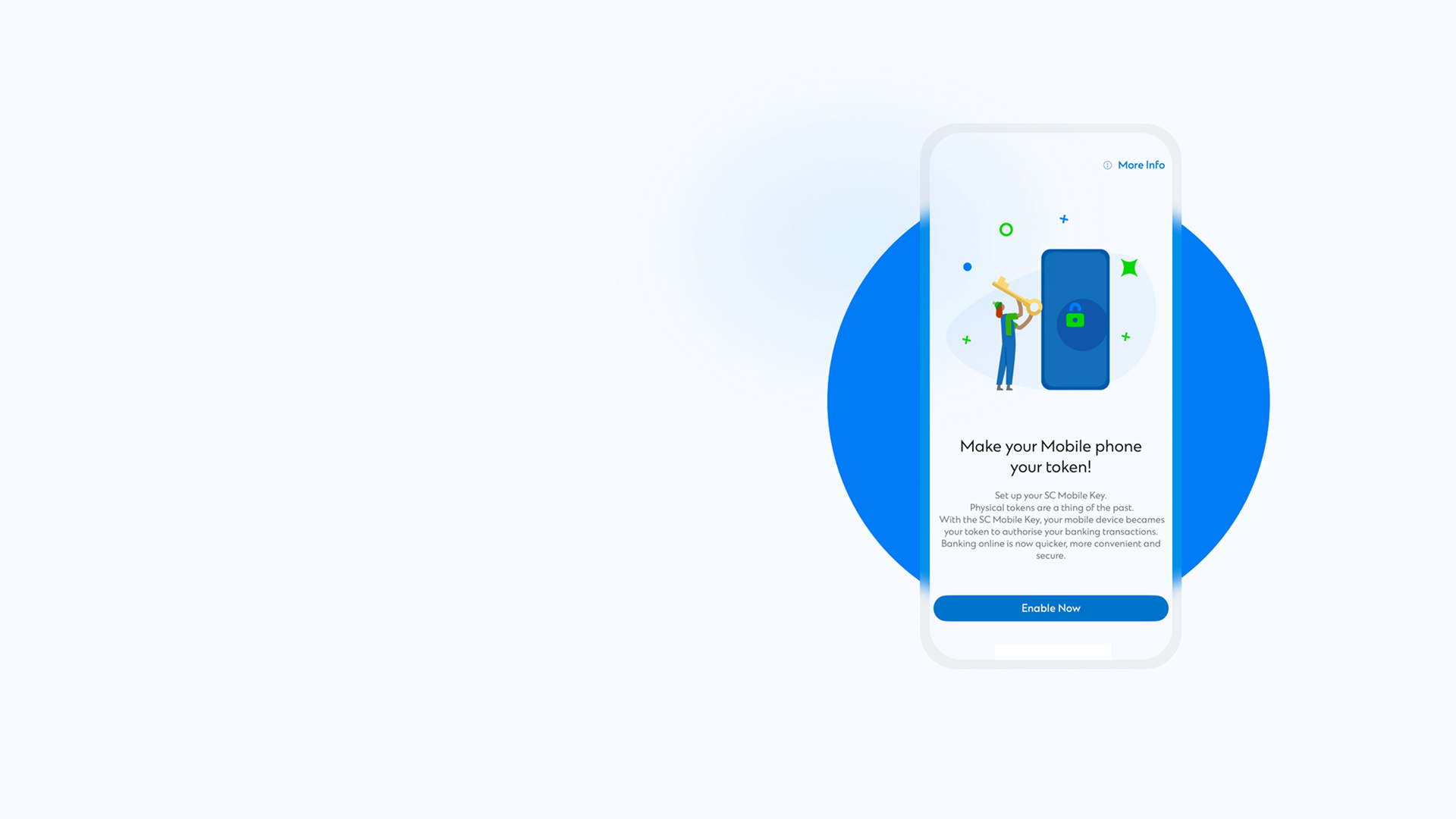

Most Improved Mobile banking Application – Singapore 2025

Best Foreign Bank for Customer Experience – Singapore 2023

Digital CX Awards

World’s Best Retail Bank for Digital CX – 2025

Outstanding Digital CX Mobile banking – 2025

The Asset Triple A Awards

Digital Bank of the Year – 2024

Best Retail Online Banking Experience – 2024