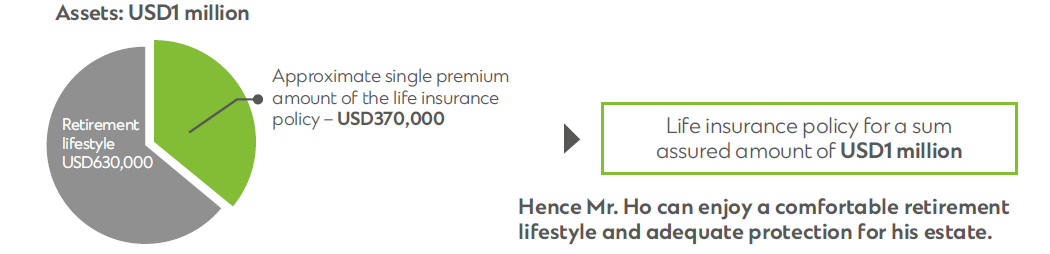

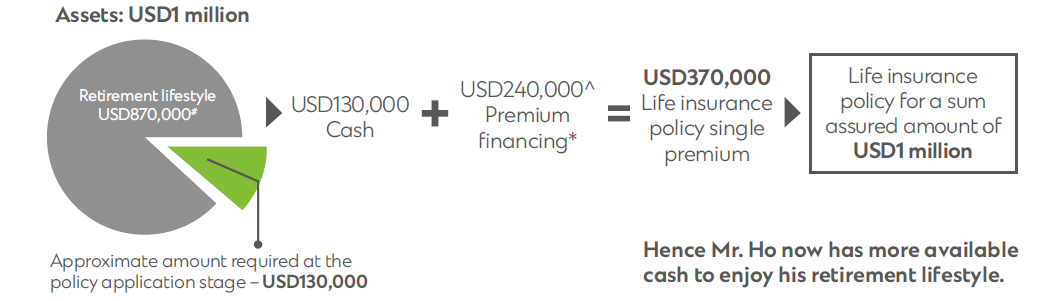

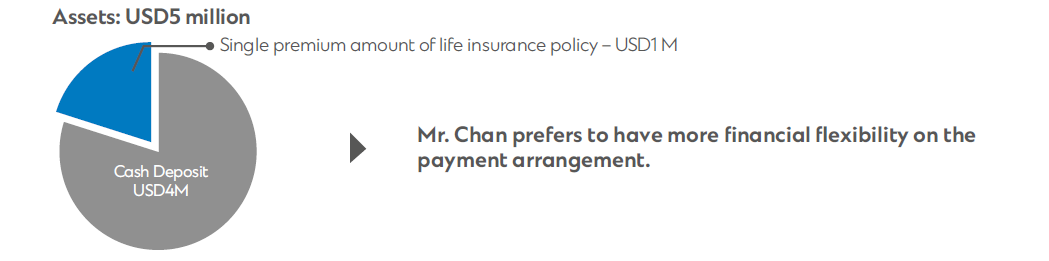

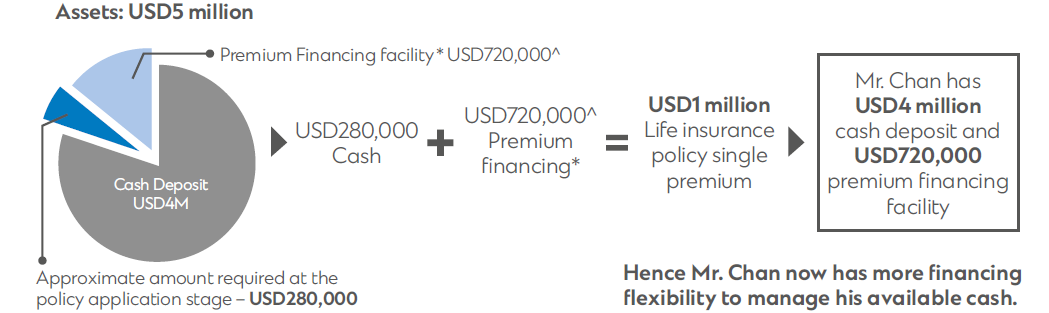

* All figures and examples shown are for illustration purposes only and contain a number of assumptions that are not guaranteed and not disclosed in this leaflet. Please also refer to the Risk Disclosure and the Important Notes

^ The approval of the premium financing facility (or the “facility”) is subject to the final decision of Standard Chartered. The amount of premium financing is calculated by reference to the Loan-to-value ratio of Surrender Value or Total Policy Value of the eligible insurance plan as at policy issue date as well as other factors at the absolute discretion of Standard Chartered.

# Subject to repayment of premium loan and loan interest payment.

The above example is for illustration purposes only and contains certain assumptions that are not guaranteed. Please refer to the product details, terms and conditions applicable to premium financing.

The information in this page is for general information and for reference purposes only. This leaflet does not constitute a contract of insurance or an offer, invitation or recommendation to any person to enter into any contract of insurance. Customers must not rely on the information in this page alone in entering into any transaction. Specific professional advice is recommended.

The life insurance policies are life insurance products underwritten by Prudential Hong Kong Limited (a member of Prudential Plc group) (“Prudential”) and distributed by Standard Chartered Bank (Hong Kong) Limited (“Standard Chartered”). Some of these plans may have a savings element and are not an alternative to ordinary savings or time deposits. Part of the premium pays for the insurance and related costs.

If you are not happy with your policy, you have a right to cancel it within the cooling off period and obtain a refund of any premium and levies paid, less any withdrawals (if applicable), provided that no claim has been made under the policy. A written notice signed by you should be received directly by the Prudential’s Office within the cooling off period (that is, within 21 calendar days immediately following either the day of delivery of (1) the policy or (2) the notice (informing the availability of the policy and expiry date of the cooling-off period) to the customer or your nominated representative, whichever is earlier). After the expiration of the cooling off period, if you cancel the policy before the end of the term, the projected total cash value (if applicable) may be less than the total premium you have paid. You should check with Prudential if you have any doubt regarding your cooling-off right.

Facility cannot be offered to clients with Australia or New Zealand Residential Address. The Bank reserves the right to reduce the maximum amount under the Facility or cancel the Facility if you have moved to Australia and reside in Australia.

Standard Chartered is an insurance agent of Prudential.

As the issuer of the life insurance policies, Prudential will be responsible for all protection and claims issues. Prudential is not an associate or subsidiary company of Standard Chartered. The leaflet is not a contract of insurance and is intended to be a general summary and for reference purpose only. Please refer to the policy for full terms and conditions. Standard Chartered does not accept any responsibilities regarding any statements provided by Prudential or any discrepancies or omissions in the contract of insurance nor shall Standard Chartered be held liable in any manner whatsoever in relation to your contract of insurance.

The information of this page is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Hong Kong. Prudential and Standard Chartered do not offer or sell any insurance product in any jurisdictions outside Hong Kong in which such offering or sale of the insurance product is illegal under the laws of such jurisdictions. The leaflet does not constitute a contract of insurance or an offer, invitation or recommendation to any person to enter into any contract of insurance or any transaction described therein or any similar transaction. Customers should not rely on the information in this leaflet alone in entering into any transaction. Specific professional advice is recommended.

Whether to apply for insurance coverage is your own individual decision. For Prudential’s life insurance policy provisions, details and risk disclosure please refer to relevant plan’s product leaflet/offering document and specimen policy.

If there is any inconsistency or conflict between the English and the Chinese versions, the English version shall prevail.