More than just a passionate pursuit

The process of getting your dream car is not just a pursuit driven by passion. Driving a dream car is not just about fulfilling fantasies; it’s about creating beautiful memories, sharing moments with loved ones, and finding a vehicle that complements your driving skills to fit both work and leisure.

What is the car purchasing process?

Regardless if you are eyeing the latest Cybertruck, considering the heavily discounted Model 3, or exploring classic used car models, the purchasing process involves several steps once you have chosen your dream car:

Arranging test drives and inspections.

Signing contracts and selecting suitable loan or finance options.

Purchasing car insurance.

Completing vehicle transfer (for used cars).

Making final payments and taking possession.

What about car loans and financing?

Choosing how to finance your car is crucial. Many opt for car loans, which come in forms like leasing or purchasing while facilitated by car dealers or agencies:

Leasing plans: No upfront payment, only monthly instalments, usually with higher interest rates.

Purchasing plans: Require an initial payment, calculated as “term length + 1” (e.g., for a 5-year term, an upfront payment for 6 months), with lower interest rates.

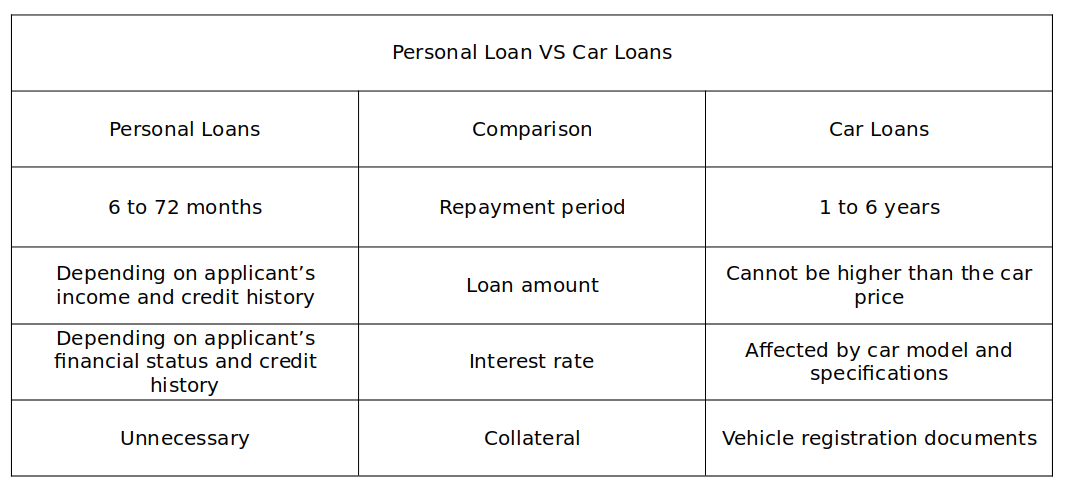

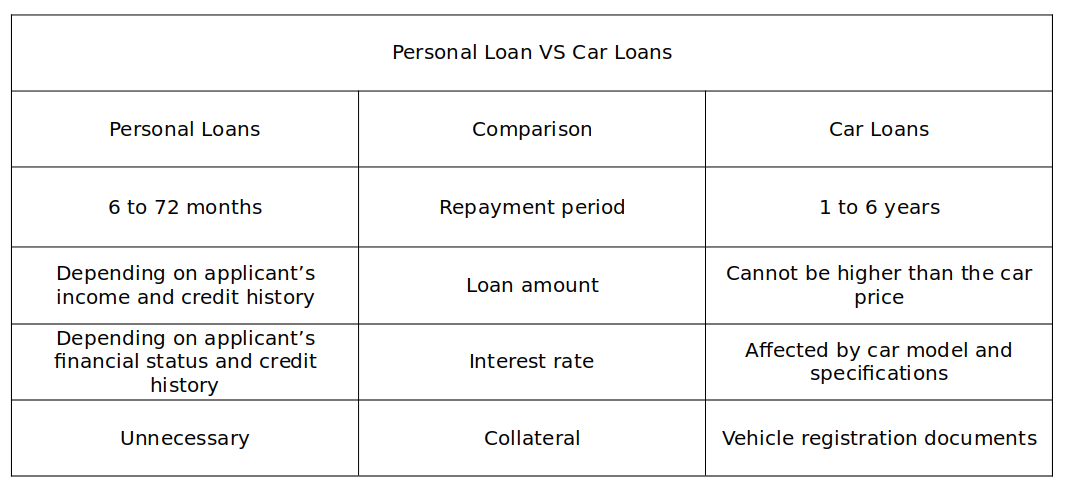

For traditional car loans, you will need vehicle registration and personal documents. The applicant must also ensure comprehensive insurance and submit the vehicle registration document (the “logbook”) as collateral, which is returned after completing payments.

Documents required for loans typically include:

HK ID

Driver’s license

Proof of address for the last 3 months

Salary or tax statements for the last 3 months

Bank statements for the last 3 months

Once submitted, initial approval usually takes a few working days.

Choosing personal loans to purchase cars

The choice to get a flexible personal loan to purchase a car has gained popularity because it provides similar interest rates to car loans and transparent information as well as requires no collateral or upfront payments. Selling the car later also becomes more straightforward.

However, the loan amount varies depending on personal financial status and credit history. Individuals with good credit records might have access to lower rates. During tax seasons, using lower interest Tax Loans to purchase vehicles is an option.

Similar to education loans, strategic use of Personal Loans sets a path for the life you envision. Our Personal Loans offer cash rebates or other promotional benefits. Using our Personal Loan calculator, you can input your desired repayment period and other details to calculate the monthly payments and average interest. The repayment terms can be extended up to 60 months, and the entire process can be completed easily online. Selected clients may be exempted from submitting documents (no proof of income and TU needed). They can also enjoy instant loan approval (in seconds) as well as various other promotional offers.

You can also visit the Investor and Financial Education Council website for more financial tips related to car purchases.