Only paying the Minimum Pay each month? Maybe it is time for a balance transfer!

Manage & Reward Your Banking

If you are not good with managing your personal finance, you may find yourself struggling with multiple cards in case of sudden large spending. In addition to installment plans, some people choose to make minimum payments (commonly known as Min Pay) each month. Min Pay may be a timely help, but it is important to assess your repayment ability before spending. If the situation does not improve, the balance and interest will keep rolling each month and become unmanageable.

If you like to use credit cards by paying Min Pay, you need to take heed of the following:

1. Loss of interest-free repayment terms

Many people like to use credit cards as it gives flexibility to cash flows and earns various bonus points and rebates. If you pay your credit card balance in full and on time, you will not incur any expenses with up to 59 days interest-free period. In fact, credit cards are a credit facility. Interest is accrued on the outstanding balance not paid up. Most credit cards charge a high interest rate. Min Pay is only making a partial repayment. The outstanding balance immediately accrues interests. You may also lose the interest-free repayment period due to credit card debt.

2. Likely downgrade of TU credit ratings

Whilst timely Min Pay does not attract penalties on the monthly statement, any outstanding balance becomes a debt. It is essentially a loan. This will eventually reflect on your TU credit rating. Lenders may think you have problems in making repayments and lower your credit score. The impact of lower TU credit ratings varies. It may affect your mortgage amount and interest rate in the future or even the immigration review for certain countries!

3. Possible snowballing of interest expenses

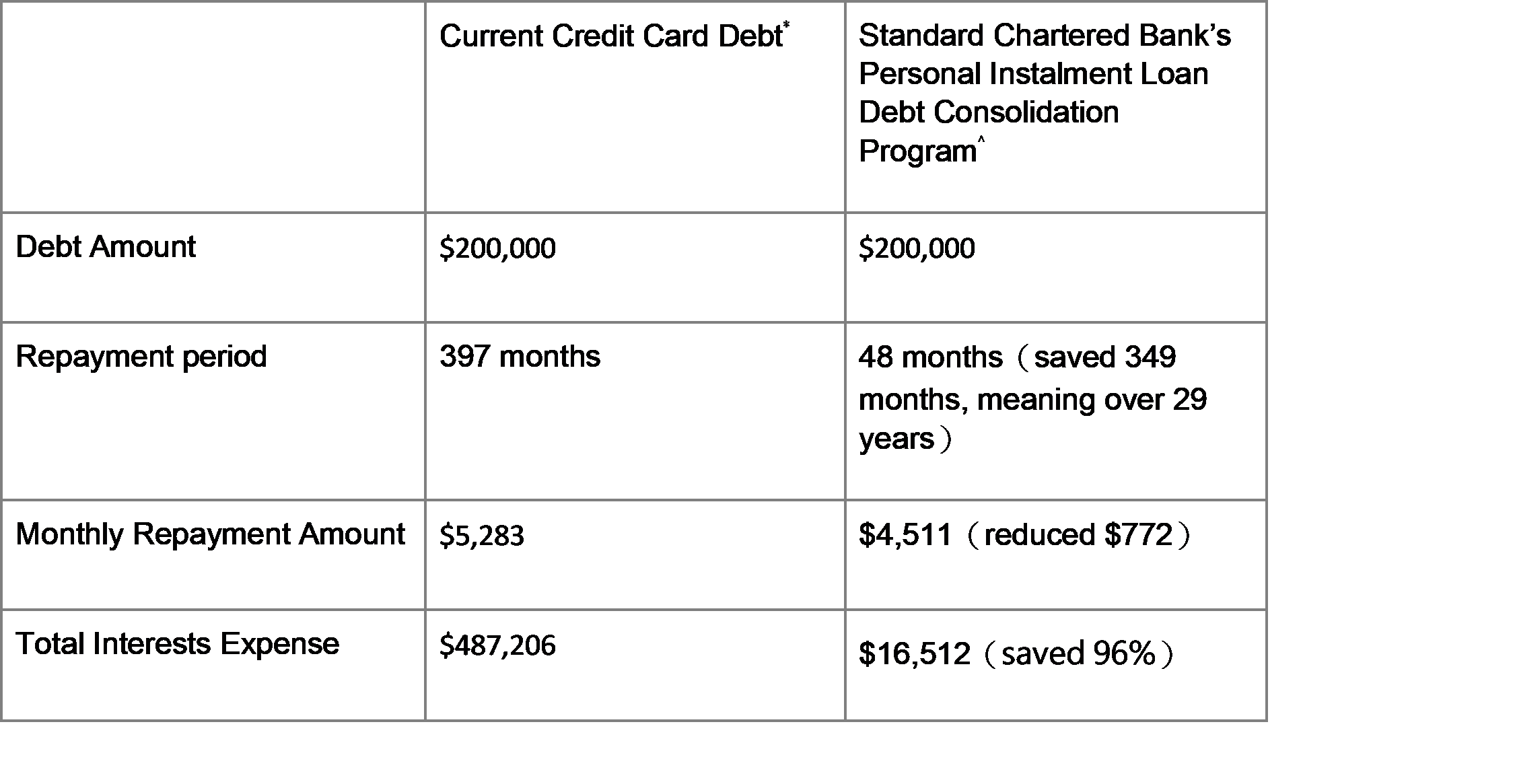

It is necessary to keep an eye on interest expenses for Min Pay. Here is a typical example.

Example*: HKD200,000 of outstanding credit card balance, 1% repayment each month at 30% annual interest rate.

Mr. A currently owes a credit debt of HKD200,000. He has been making minimum payments due to a lack of sufficient cash flow. However, Mr. A’s finance has not improved for months. He can only afford Min Pay.

As a result of HKD200,000 in the outstanding balance and Min Pay for months, it will take 397 months to pay off the debt. Almost 33 years! The interest incurred adds up to $487,206, more than double of the principal! If Mr. A continues to spend with the credit card when making Min Pay or has outstanding balances with other credit cards, the number will be even scarier.

Balance transfer – lower interest expenses with debt consolidation

If you do not think Min Pay is the solution… You may consider debt consolidation in order to reduce the interest burden by consolidating debts.

When a person realizes credit card debts are a problem, the situation is usually already very serious. Even keeping up with Min Pay is difficult. Assume a regular working earning HKD20,000 per month has multiple credit cards. If his long-term borrowing exceeds HKD200,000, Min Pay per month may be about HKD5,200 or higher. Repayments will be demanding. This is a problem developed over time due to a lack of proper personal finance management. However, there is a solution. You may consider applying for a debt consolidation program. It is a type of personal borrowing. You may consolidate multiple debts with a balance transfer on a lower interest rate. Making regular repayments at a lower interest rate will greatly reduce your burden.

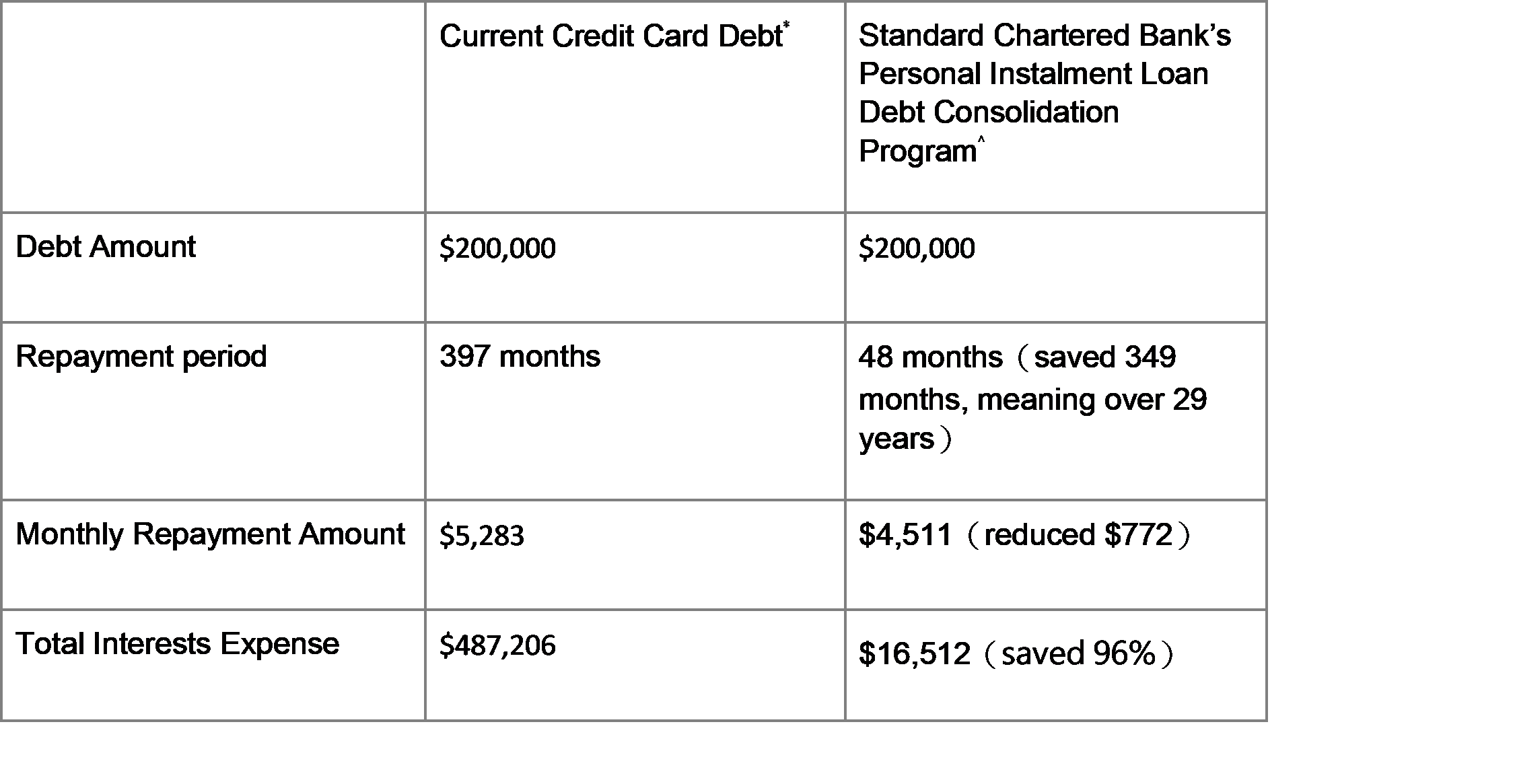

Below is an example of Standard Chartered Bank’s Personal Instalment Loan Debt Consolidation Program. Let us see what difference a balance transfer on a month repayment period can make with a credit card debt of HKD200,000:

Confront the issue and solve your credit card problem

The above example shows that balance transfers can greatly shorten the repayment period and lower monthly repayments and total interest expenses! A monthly repayment of $772 less on the same outstanding balance. Full repayment in four years! Debt Consolidation merges high-interest credit card debts and personal loans into a single bank account so that you only have to make one monthly repayment. This reduces the burden of financial management.

Other than debt consolidation, you may also consider different loan services to solve your debt troubles. Please visit https://www.sc.com/hk/loans/ for more details on different loans.

Above data for reference only.

This data is not advice for borrowing and does not constitute offers, solicitations or recommendations for any loan products.